Association of Chartered Certified Accountants - (ACCA)

ACCA Certified Accounting Technician (CAT)

ACCA Certified Accounting Technician (CAT) is a technician-level professional qualification awarded by the ACCA (Association of Chartered Certified Accountants).

The qualification provides you with competence in accountancy, IT and aspects of management in order to support the work of professional accountants.

There is no time limit on completion of the qualification and it offers anyone who has no formal qualifications the opportunity to pursue an internationally recognized qualification.

Duration Minimum One Year.

The fantastic flexibility of the CAT qualification means that the course can be completed in as long or as short a period as you wish.

At the campus, we offer you three convenient routes to obtain your CAT qualification; the "Express Route", the "Normal Route", and the "Extended Route".

Express Route

The express route commences in January & July each year Computer Based Exams (CBEs) are taken in February and August for the CAT Introductory Level and April and October for the CAT Intermediate Level.

You then study Paper 5 in preparation for the June and December exams.

The four papers at the Advanced Level will then be completed from July to November and January to May, and you will attempt the written examinations in December and June.

You will therefore be able to complete the CAT qualification in a year.

To complete the course in this period, there will be an average of four lectures per week.

Normal Route

The Normal route commences in April and October each year and allows a more leisurely introduction to your CAT studies.

There are the same number of lectures as the Express Route, but they are spread over a longer period, averaging two per week until December and June, when you complete Paper 5.

The pace of the course then intensifies, and you complete the remaining four papers of the Advanced Level over a five month period.

On completion of the CAT qualification, graduates have direct entry to level 2 of the ACCA qualification.

Entry Requirements

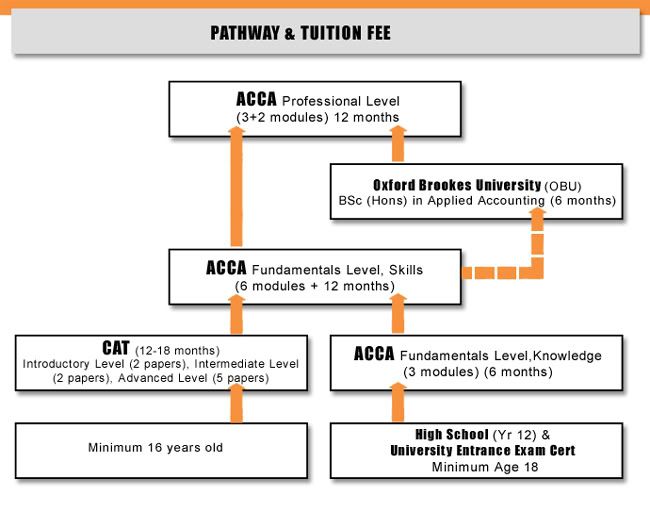

Age 16 + years with no formal qualifications

Examinations

Examinations are held twice a year in June and December for Level C

Computer-Based Exams (CBEs) for Level A and Level B can be taken at any time at campus (pre-registration required)

Exemptions

If you have no qualifications, you will be expected to complete all three levels of the Certified Accounting Technician examination.

Other relevant qualifications will receive exemptions from some or all papers.

All students must satisfy the work experience requirement to complete the CAT qualification.

Course Structure

At our campus, we believe that it's vital that you understand the subject matter of each syllabus and also know how to apply that knowledge in answering examination questions.

Each of our courses therefore consists of a 'teaching phase', where you will be given the knowledge you need to pass the exam, and a 'revision phase', where you will refresh your knowledge and enhance your exam techniques.

For students who are taking a paper for the second time, we offer you the flexibility of only attending a revision course.

Course Contents:

Introductory Level:

Paper 1: Recording Financial Transactions

Paper 2: Information for Management Control

Intermediate Level:

Paper 3: Maintaining Financial Records

Paper 4: Accounting for Costs

Advanced Level:

Paper 5: Managing People and Systems

Paper 6: Drafting Financial Statements

Paper 7: Planning, Control and Performance Management

2 options from:

Paper 8: Implementing Audit Procedures

Paper 9: Preparing Taxation Computations

Paper 10: Managing Finances

All Fees are subjected to changes from the participating institutions, prevailing goods and services tax & exchange rates. For more information, please email your questions to:

The Association of Chartered Certified Accountants - (ACCA)

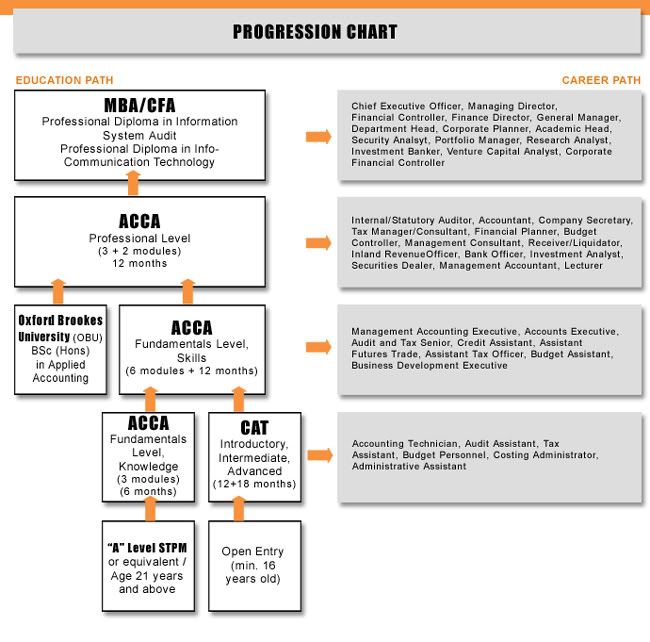

The ACCA (Association of Chartered Certified Accountants) qualification provides you with a sound base on which to build a career in finance or related areas.

As an ACCA trainee, you will develop a wide range of skills, giving you an in-depth knowledge of accounting principles, management techniques and IT, enabling you to work in any area of finance and creating a world of opportunities for your future.

The ACCA also offers a truly global qualification in which students can choose, in some papers, to be examined using international accounting and auditing standards.

There are also Singapore variant papers in tax and law.

This means that your ACCA qualification is truly portable, enabling you to live and work in many countries around the world.

The examinations cover all aspects of business management from the purely technical - such as bookkeeping and cost accounting - to the more theoretical aspects such as motivational theory and theories of risk.

"ACCA is the largest and fastest-growing global professional accountancy body in the world, with over 493,500 members and students in 170 countries. ACCA has an extensive network of almost 80 staffed offices and other centres around the world."?

- Source: ACCA website.